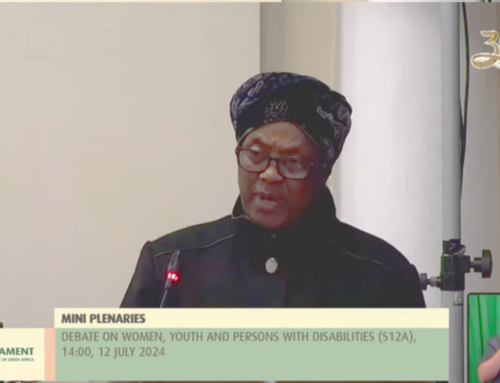

Address by Mr NL Kwankwa, MP in the National Assembly

Hon Speaker and honourable Members

Savings and Investment are critical tools for a sustainable economic development and improvement of conditions of life of all nations.

The reported shift from the panic “I can’t afford the cost of living” to action; cutting back on spending and paying down or avoiding debts and invest more, is a positive development, however, it is enabling few from urban and historical advantaged citizens.

Each year, a certain percentage of households confirm to be earning more than the previous year, yet this is not directly translated into equal percentage increase on savings and investments instead increases the level and margins of daily consumption.

Old Mutual Saving Monitor reported in July 2012, that there is a decrease in informal saving yet such has not resulted to any significant swing in favour of a particular type of saving.

Further, this report showed that South Africans saving and investment were recorded in 2014 as follows:

• 37% Life assurance / death and disability covers;

• 24% Retirement Annuity;

• 57% Pension/Provident Fund;

• 27% Education;

• 72% Funeral policy / plan and

• 34% No formal retirement savings

Facts are that, most people are saving for lavish funerals than life after formal employment and this affects mainly the historically disadvantaged citizens.

This trend, if left as is, will certainly result to increase of citizens who retire to be beneficiaries of government grants.

Accordingly, any attempts by government and the people of South Africa to intervene and ensure improvement in terms of savings and investment calls for our collective support as this house.

Further, and in particular for those in the dark about the importance of a saving and investing nation more investment by government on education and education is one of the tools to be used to turn around the situation.

We must as a nation and deliberately resist the temptation to expand the margins of the state security bracket.

I thank you